.webp)

Shubham Patil

Chief Marketing Officer

Raj Solanki

Co-Founder

October 31, 2025

.jpg)

Pumpkn is a South Africa–based fintech company empowering small and medium businesses in the food and agriculture sector with fast, flexible funding. Their vision is to back the entrepreneurs driving South Africa’s future in these domains.

As the brand grew, inquiries about funding started flooding in from business owners across the country. Many were dropping off midway through the loan process, and the team spent hours manually handling repetitive questions, collecting documents, and qualifying leads. Pumpkn needed a solution that could make the funding journey faster, simpler, and digital, without losing the human touch.

Pumpkn’s sales and operations teams were spending significant time managing incoming leads, manually qualifying them, and explaining loan terms. Each customer needed to understand eligibility criteria, funding options, and documentation requirements, often through back-and-forth messages.

These friction points created bottlenecks:

To make it super easy for prospective customers, Pumpkn wanted a fully automated WhatsApp journey that could capture, qualify, and convert leads, while generating real-time loan quotations and submitting complete applications directly into their CRM.

Swiftsell deployed an AI-powered WhatsApp automation that instantly engages new users when they message Pumpkn. The AI greets the user, collects their details and funding intent, and routes them to the right flow, whether to explore loan options or begin a full application. This replaced manual lead intake and ensured every inquiry received an immediate, personalized response.

Through intuitive chat menus, users can explore Pumpkn’s “Funding Ladder” and understand eligibility requirements in a clear, conversational way. Instead of static FAQs or forms, the AI dynamically answers questions, guiding users toward the most relevant funding path, helping reduce confusion and improve loan readiness.

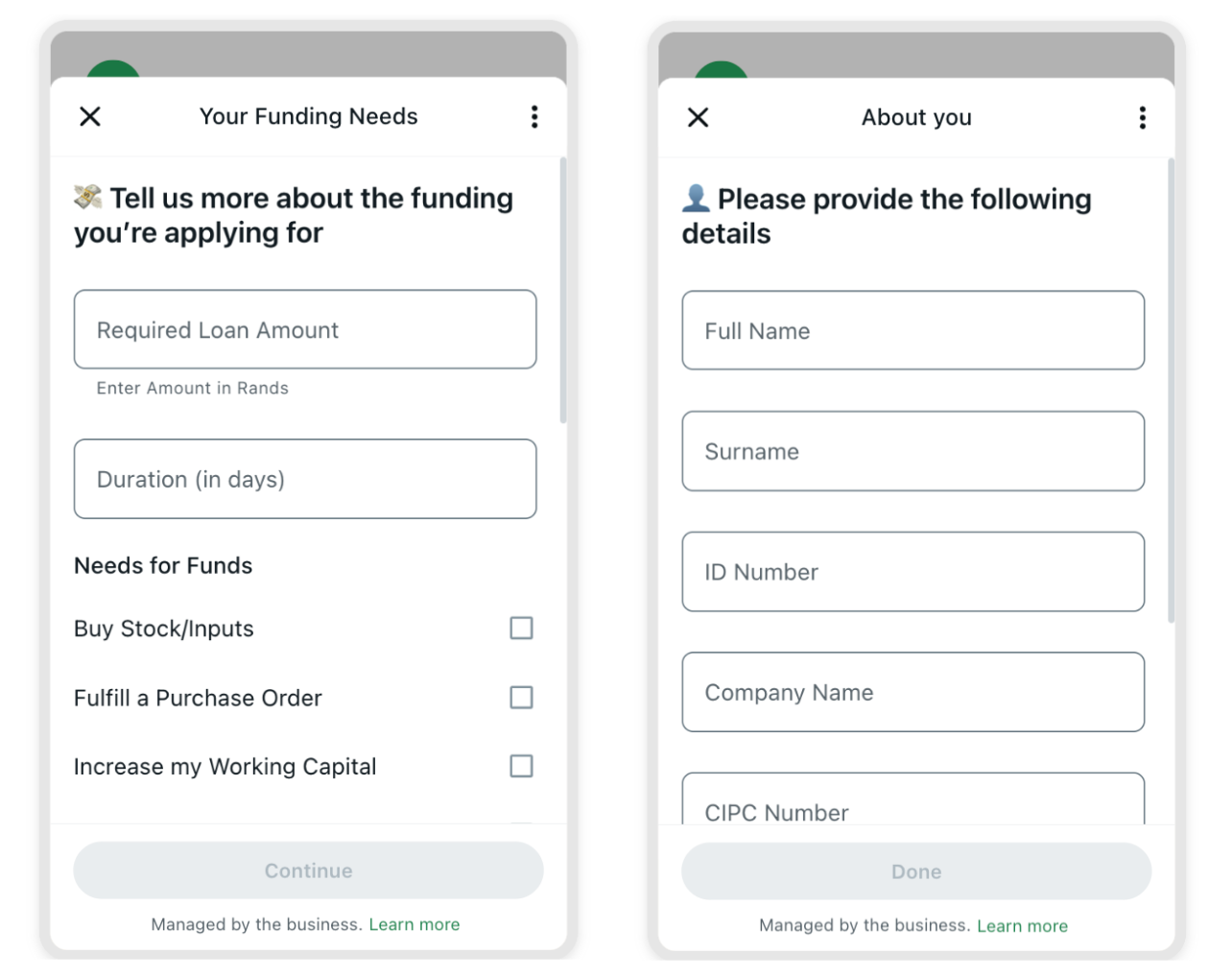

Swiftsell connected directly with Pumpkn’s backend via APIs to automate loan quotations. When users enter their desired loan amount and term, the system instantly fetches an indicative quote with repayment options and personalized recommendations. What once took hours of manual back-and-forth is now delivered instantly within WhatsApp, boosting engagement and ease of use.

4️⃣ End-to-End Application Automation

Once a user decides to apply, they can upload documents right within WhatsApp or choose to continue later without losing progress. The system then presents digital Terms & Conditions, collects consent, and automatically submits the completed application to Pumpkn’s CRM through a secure API call.

All lead activity, from inquiries to submissions, is tracked inside Swiftsell’s contact dashboard. Unfinished applications trigger automated WhatsApp reminders, ensuring high completion rates. Pumpkn’s team can view all leads in real time, filter them by source, and take over conversations whenever necessary.

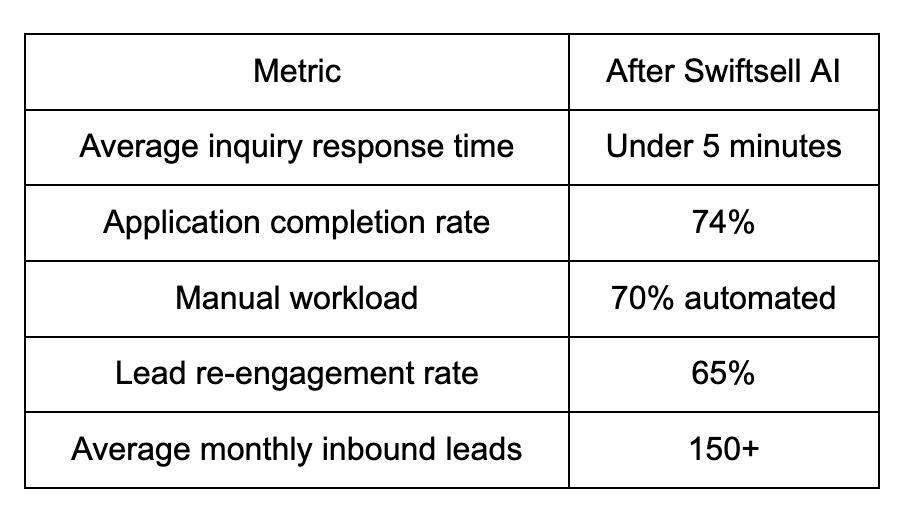

Swiftsell transformed Pumpkn’s WhatsApp channel into a complete digital funding assistant, one that could inform, qualify, and convert customers autonomously.

By integrating real-time APIs, multi-step automation, and compliance-friendly consent collection, Swiftsell helped Pumpkn achieve what traditional CRM workflows couldn’t: a human-like loan experience delivered by automation.

The system not only reduced operational overhead but also improved accessibility — making it easier for small businesses across South Africa to get funding quickly and confidently.

“Swiftsell turned our WhatsApp into a digital loan officer. Customers now get quotes instantly, upload their documents, and complete applications without waiting for an agent. It’s made funding faster, smarter, and far more accessible.”

With Swiftsell, Pumpkn built a 24×7 funding assistant that handles inquiries, qualifies leads, generates instant loan quotes, and completes full applications, all on WhatsApp.

The result: Faster funding. Smarter conversations. Happier customers.